You're likely aware that AI's role in finance is growing rapidly. While it brings efficiency and tailored solutions, there are rising concerns about its risks. Cyber vulnerabilities and market distortions could threaten stability. Mike Armstrong emphasizes the need for strong data management and regulatory frameworks. What does this mean for the future of financial innovation and consumer protection? The answers might surprise you.

As the financial industry rapidly embraces artificial intelligence, you might wonder about both its transformative benefits and the potential risks it brings. AI has revolutionized how financial institutions operate, increasing operational efficiency through automation and enhancing data processing capabilities. It streamlines mundane tasks, allowing your team to focus on strategic decision-making. Moreover, AI helps ensure regulatory compliance by meticulously analyzing financial transactions, reducing the risk of penalties and enhancing trust. Content clustering is a technique that can be employed by financial institutions to organize information effectively.

In addition to compliance, AI empowers financial product customization. You can create personalized financial solutions tailored to individual client needs, enhancing customer satisfaction and loyalty. With advanced analytics, AI improves your decision-making processes, providing insights that can guide investments and risk management strategies. Recent reports indicate that AI adoption is increasing rapidly within the financial sector.

However, it's essential to recognize that while AI offers many advantages, it also introduces significant risks. One concern is the growing dependency on third-party AI service providers, which can increase operational risks. If a service provider faces issues, your entire operation could be affected.

Furthermore, AI's capabilities may unintentionally amplify market correlations, leading to herding behavior among investors. This can create systemic risks that threaten financial stability. Cyber risks are another critical issue. AI systems, while sophisticated, aren't immune to cyber attacks. A breach could compromise sensitive financial data, leading to catastrophic consequences.

Additionally, the accuracy of AI models hinges on the quality of data fed into them. Flawed models or biased algorithms can result in poor predictions, potentially causing significant financial losses. Financial fraud is yet another area of concern. While AI can help detect fraudulent activities, it can also facilitate new forms of fraud, posing substantial threats to the integrity of financial systems.

As you reflect on these challenges, the impact of AI on financial stability becomes more apparent. It can distort market information processing, increasing the likelihood of financial crises. Looking ahead, the future of AI in finance holds promise, but it also requires vigilance.

Technological advancements continue to evolve, enhancing financial services. However, data management and model governance present adoption challenges that can't be overlooked. As regulatory frameworks struggle to keep pace with AI's rapid development, new policies may be necessary to mitigate AI-driven financial fragility.

In navigating this complex landscape, staying informed about both the benefits and risks of AI in finance is crucial. Balancing innovation with caution will help you leverage AI's potential while safeguarding your financial future.

As an affiliate, we earn on qualifying purchases.

Financial Data Engineering: Design and Build Data-Driven Financial Products

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

The AI-Driven Financial Fraud Detection System: A technical guide to building and deploying advanced machine learning models

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

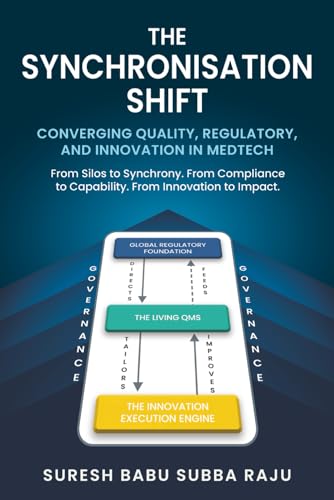

The Synchronisation Shift: Converging Quality, Regulatory, And Innovation In MedTech: From Silos to Synchrony. From Compliance to Capability. From Innovation to Impact.

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.